What's the Minimum Amount I Need to Buy A House?

We’re going to discuss the costs a homebuyer faces and what options exist to bring in the minimum amount of money when you buy a house. I’m going to talk about the down payment, inspections, earnest money, and closing costs. A couple of the items are pretty straightforward but a couple of others are usually a bit more confusing for folks so we’ll try to get past that confusion. At the end, I have a couple of examples in both written and spreadsheet form.

Please keep in mind that the thrust of this article is to answer the question, “How much money do I need to buy a house?” With ‘need’ in this question, it’s my goal to explain what the minimum potential investment is. There are other sides to all of these points that aren’t our focus today. As an example, in the discussion of the down payment: the advantage of a small down payment is that it’s the least money out of pocket (what we’re looking for in this article); the disadvantage is that the less money down, the bigger the loan, and so the higher the payment. A bigger down payment can sometimes improve your rate, as well.

Down Payment

Long gone are the days of needing 20% as a down payment. In fact, in many areas of the country, a 20% down payment would mean that very few first-time homebuyers would ever become first-time homebuyers. 20% down is a prohibitively big number for most folks who aren’t using equity from a previous home.

There are many programs that allow very little – in some cases zero – down payment on a primary residence. Three of the ‘biggies’ that you may have heard of are VA, FHA, and USDA. These three are all legitimate, government-backed programs from way back (FHA was started in the 1930’s, during the Great Depression). There are many other programs as well – some universal and some specific to certain banks.

You are unique and your loan officer will let you know what programs you qualify for. But these programs mentioned are not ‘difficult’ to qualify for – as a matter-of-fact, they can be easier in some respects. FHA has insured over 40 million loans since its inception. And, in 2020, 83.1% of FHA borrowers were first-timers.

- Synopsis of ‘Down Payment’

Minimum money needed for a loan: 0% to 3.5% of purchase price.

Money to Hire Real Estate Agent

Good news! As a buyer, you typically don’t pay the real estate agent… the seller does. So you can just toss that worry right into the rubbish bin, right now.

- Synopsis of ‘Money to Hire Agent’

Zero.

Inspections

When you buy a home, it is prudent to have the house inspected (inspections are your choice and can be waived but this is usually a bad idea). Usually a buyer will want a whole-house inspection and a few ancillary inspections (e.g. a sewer line inspection or a termite inspection). Inspections vary regionally of course: termites, for example, don’t dine in all parts of the country.

Customs are also regional. In the Portland, Oregon market, the buyer typically pays for the inspections at the time they are performed (usually shortly after mutual acceptance of an offer). There are other areas where the seller generally has the inspection(s) done ahead of time. Your agent will know how this works in your area.

If you live in an area where the buyer pays for the inspections, this will be money that you, as the buyer, will need to have readily available. This amount will vary. As mentioned, in my local market, typical inspections might include a whole-house inspection, a sewer line inspection, and a radon inspection. The total for all three of these might be from $700 to $800. (Details about inspections are outside of our topic: your agent is the best source of inspection needs and costs).

- Synopsis of ‘Inspections’

Minimum money needed for inspections: $0.00 to $2,000, typically (highly dependent on your area and the inspections needed). For Portland, Oregon, I would recommend budgeting $1,000 for a typical house and transaction.

We’ve covered agent fees, down payments, and inspections. The next two items we will discuss are closing costs and earnest money. These usually cause a bit more confusion.

Buyer’s Closing Costs

In a real estate transaction, there are always closing costs for both the buyer and the seller. Closing costs pay for escrow, title, attorneys, taxes, insurance, lender fees, broker fees, et cetera. When buyers don’t have enough cash on hand to cover their closing costs and down payment, most loan programs will allow the seller to pay for the buyer’s closing costs up to a certain amount (depending on the loan program). When a seller pays the buyer’s closing costs, that amount is taken from the seller’s proceeds – so if the seller would have received $20,000 upon sale but agrees to pay $5,000 in buyer’s closing costs, the seller will now receive only $15,000.

Why would a seller pay the buyer’s closing costs? There are a couple of reasons. First, the seller wants to sell! If an offer makes sense, the seller wants to try to work with the buyer to put the deal together. Second – and this is the part that confuses folks at first – the seller can still net the same amount on her sale while paying the buyer’s closing costs and reducing the buyer’s up-front cash needs.

Let’s use an example:

Sally Seller is asking $250,000 for her house. Boris Buyer wants the house and has enough for the down payment that his loan requires. But the closing costs are an additional $8,000 which Boris does not have.

Sally Seller is not willing to accept less than $250,000. If Boris asks her to pay the $8,000 of his closing costs, she would, in effect, be accepting $250,000 minus $8,000, or $242,000. She’s not willing to accept $242,000 and Boris doesn’t have the $8,000. So, the deal’s off, right? Maybe not.

Boris and his agent, both clever negotiators, decide to offer $258,000… $8,000 more than Sally is asking. But they ask Sally to pay the $8,000 in closing costs, out of her proceeds. So Sally will now net $250,000 (the $258,000 minus $8,000). She gets the $250,000 she wants and Boris doesn’t have to come up with $8,000 in up-front cash.

A happy ending for all!

What just happened? Let’s examine it in more detail, including a little backstory.

Boris went to Lindsay Lender at The Loan Lair and was pre-approved to buy a home for a maximum of $260,000. Boris’s down payment requirement for his loan was 3.5% of the purchase price. So, if Boris buys a house for the pre-approval maximum of $260,000, this means a $9,100 down payment. His agent, who I’ll call Rob Realtor (convenient, I know) has informed Boris that the inspections will be $900. $9,100 down payment plus $900 inspections totals $10,000. Boris has $12,000 set aside for all of his home buying expenses. After the down payment and inspections, Boris would have $2,000 left.

Boris knows that his closing costs are going to be substantially more than that $2,000. So Boris, Lindsay Lender, and Rob Realtor discuss it and decide to ask the seller (once Boris finds a house) to pay Boris’s closing costs. This also leaves the $2,000 – enough for Boris to buy a new dining room table and the Toro Personal Pace Auto-Drive lawn mower he’s had his eye on.

Boris sees Sally’s house and falls in love with it – time to write an offer! Rob Realtor talks to Sally’s agent – there are apparently a few other offers circling. Sally Seller is in a strong position because of the potential multiple offers. Rob Realtor and Boris feel they must offer full price to be competitive, so Boris offers $258,000 with the seller paying $8,000 in closing costs. This will net Sally her full $250,000 price and take care of Boris’s closing costs, all in one move. Sally accepts the offer – they have a deal!

So Sally is paying the closing costs, right? On paper, it shows Sally paying the $8,000 closing costs… but is she really? In effect, she is not. Boris is ultimately paying the $8,000 because he has increased the amount of the loan by $8,000 rather than pay with cash up front.

To put this another way, if Boris had had an additional $8,000 cash in the bank, he would have had enough cash to pay the full $250,000 purchase price plus $8,000 in closing costs, for a total of $258,000. Because he did not have that additional $8,000 in the bank, however, Boris bought the house for the ‘bumped-up’ price of $258,000 but with $0.00 in closing costs, also for a total of $258,000. It was the same amount, either way.

Buying the house using this bumped-up price allowed Boris to get into the house without having to come up with the cash for the closing costs. If he hadn’t been able to do this, he would have had to wait long enough to save up an additional $8,000!

In the end, how you choose to look at who’s paying the closing costs is up to you. When they’re rolled into the transaction rather than paid in cash by the buyer, then – technically and on paper – the seller is paying the buyer’s closing costs. From a more pragmatic standpoint, if the purchase price is being increased to do this, one could say it’s the buyer paying them. Rivetingly interesting though that discussion may be, the important point is that the buyer doesn’t need to come up with the smackeroos.

- Synopsis of ‘Buyer’s Closing Costs’

Minimum money for Buyer’s closing costs: $0.00, if seller is paying all of buyer’s closing costs. Closing costs (obviously) can go up from there, dependent on time of year (because of property tax payment cycles), purchase price, etc.

Earnest Money

Earnest money is a sum that you deposit to demonstrate – by putting money on the line – that you’re a serious buyer. Earnest money, in my area, is typically 1% of the purchase price. This is a ‘norm’, not a requirement or a law – ultimately it is the seller’s decision. If the seller is willing to accept $0.00 in earnest money, then so much the better – but most sellers probably will not.

If there is earnest money, you, as the buyer, will usually be required to produce it within a few days of the acceptance of your offer. Unlike with closing costs, there aren’t ways around this. Unless the seller has agreed to accept zero earnest money, you’ll have to come up with this money in the short term and it will be tied up until you’ve closed the transaction.

Depending on how your purchase is structured, one of three things will happen to the earnest money at the close of the transaction: you’ll get it all back, you’ll get some of it back, or it will all be credited to any costs you have in the transaction, i.e. down payment and any closing costs you, the buyer, are paying.

It is possible to have a transaction where you pay no down payment and no closing costs. If this is the case, your earnest money will be returned to you after closing. (There is a misconception that earnest money is ‘just extra’ that goes to the seller – it does not. It is credited to your side of the balance sheet. If the earnest money is more than what is owed, it will be given back to you.)

At the very end of the transaction, the closer (usually a title / escrow company or an attorney) will crunch the numbers to come up with the total owed by you (or not, as the case may be) as a buyer. This total will be equal to your closing costs plus your down payment. Next, your earnest money will be credited to this total and you will pay (by cashier’s check or by electronic wire) the remainder.

So, keeping the numbers simple, let’s look at an example where the down payment is $10,000 and you are paying your own buyer’s closing costs of $7,000, for a grand total of $17,000. (In reality, the closing costs will be a messy number, like $7,123.47). $17,000 is the total amount you owe to the transaction to make it close. If, at the beginning of the transaction, you had deposited $5,000 earnest money, it would be credited and you would pay the remainder. $10,000 down payment + $7,000 closing costs = $17,000. $17,000 - $5,000 earnest money = $12,000. (In other words, you’ll bring a check for $12,000 to the closing table).

In another example, where you have zero down payment (100% financing) and the seller is paying all of your closing costs, you will receive a check or wire back for the amount of your earnest money. $0.00 down payment + $0.00 closing costs - $5,000 earnest money = -$5,000. (If the number is negative, it is coming back to you!)

The next section will go over more examples, tying in everything we’ve talked about in this article.

- Synopsis of Earnest Money

Minimum money for earnest money: $0.00 but this is not always possible. 1% is the norm in some areas. Sellers can potentially accept $0.00 but this is unlikely. If required, there is no way around earnest money. The good news is, if the rest of the transaction is structured appropriately, all of the earnest money can come back to you.

Example Scenarios

Now, let’s put all of these elements together in a couple of scenarios. These are fictitious and the numbers used are partly for convenience (for example, 2% for closing costs might be reasonable but it could also be way off. This is just for illustration of the principle.)

Scenario #1

100% Financing, Seller Pays Buyer’s Closing Costs

Here, the buyer is purchasing a house with $1,000 out of pocket (see yellow line). His financing requires no down payment and his closing costs are covered by the seller.

Loan Type: VA with 100% financing

Purchase Price: $500,000

Down Payment: $0.00

Earnest Money: $5,000 (1%)

Buyer’s Closing Costs: $10,000 (All Buyer’s Closing Costs paid by Seller)

Inspections: $1,000

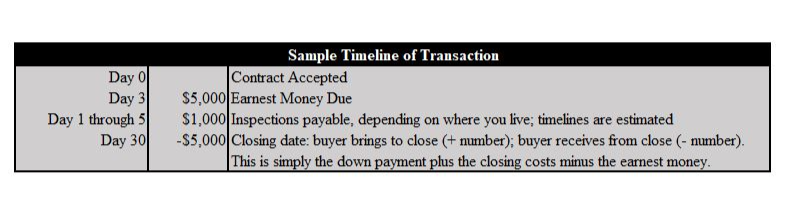

This second table shows a timeline of how long the earnest money might be tied up and when the earnest money and inspection money are due. This will depend on where you live – you need to consult your agent to discuss how this will work in your situation and area.

Scenario #2

Down Payment Required, Seller Pays Buyer’s Closing Costs

Here, the buyer is purchasing a house with $18,500 out of pocket (see yellow line). His financing requires a 3.5% down payment and his closing costs are covered by the seller. The difference between this Scenario #1 and the first is simply that a down payment is required. The closing costs are all still being paid by the seller.

Loan Type: FHA with 96.5% financing (maximum FHA loan amount = 96.5%)

Purchase Price: $500,000

Down Payment: $17,500

Earnest Money: $5,000 (1%)

Buyer’s Closing Costs: $10,000 (All Buyer’s Closing Costs paid by Seller)

Inspections: $1,000

Scenario #3

100% Financing, Buyer Pays Own Closing Costs

Here, the buyer is purchasing a house with $11,000 out of pocket (see yellow line). His financing requires a 0% down payment but his closing costs are not covered by the seller.

Loan Type: VA with 100% financing

Purchase Price: $500,000.00

Down Payment: $0.00

Earnest Money: $5,000 (1%)

Buyer’s Closing Costs: $10,000 (Not paid by Seller)

Inspections: $1,000

Scenario #4

Down Payment Required, Buyer Pays Own Closing Costs

Here, the buyer is purchasing a house with $28,500 out of pocket (see yellow line). The buyer is paying both the down payment and her own closing costs.

Loan Type: FHA with 96.5% financing (maximum FHA loan amount = 96.5%)

Purchase Price: $500,000.00

Down Payment: $17,500

Earnest Money: $5,000 (1%)

Buyer’s Closing Costs: $10,000 (Not paid by Seller)

Inspections: $1,000

Scenario #5

100% Financing, Seller Pays Buyer’s Closing Costs, Seller Requires No Earnest Money, Buyer Waives Inspections

Here the buyer is purchasing a house with $0.00 out of pocket (see yellow line). This is a less likely scenario because a seller is usually going to require earnest money. And waiving inspections is rarely a good idea. But this is a possible scenario that you could definitely make work if it made sense – it would probably require a bit more looking than the others – in order to find the right seller.

Categories

- All Blogs (15)

- Buyer (7)

- Economics (2)

- Financing (5)

- Holiday (1)

- Investor (3)

- Lake Oswego (1)

- Loan (4)

- Molalla (1)

- Mortgage (4)

- Neighborhoods (1)

- Portland Oregon (2)

- Pre-approval (3)

- Pre-qualify (1)

- Real Estate Knowledge (7)

- Real Estate Market (5)

- Real Estate Terms (1)

- Seller (4)

- Things to do in Portland Oregon (2)

Recent Posts

GET MORE INFORMATION