An Email to a Client About Buying and Selling in Our Slow Market

My clients, who want to buy and sell a new home, asked me if it were better to act now or wait until spring. Ultimately, as I'm not omniscient, there is no 'right' answer to give. But this is how I view it - a 'bird in the hand' approach. This email was a couple of weeks ago. My clients, in the

Oregon Property Taxes

Green and Yellow - Tax a Fellow It’s Oregon Property Tax Time and… I’m conjuring up mental images… your bill is either green or… wait, it’s coming to me… yellow! You may not have realized there were two colors (since you only see one tax bill at a time) and that these colors have significance.

Living in Lake Oswego

Nestled in Clackamas County, Oregon, Lake Oswego stands out with its unique blend of scenic vistas, esteemed educational institutions, and luxury residences. If Lake Oswego is on your radar for a potential move, this comprehensive guide has got you covered. The Lake Oswego Lifestyle: Peace Meets C

Why Your Portland-Area Home isn't Selling as Fast as You'd Like

VIDEO! Do rising foreclosures mean a crash?

There's been a lot of talk for a year or so about the troubles with the real estate market: the crash is coming, it's 2008 all over again... oh my! Here's one minute of thought on that subject.

The Life of an Escrow Infographic

The Life of an Escrow infographic.

What's the Minimum Amount I Need to Buy A House?

We’re going to discuss the costs a homebuyer faces and what options exist to bring in the minimum amount of money when you buy a house. I’m going to talk about the down payment, inspections, earnest money, and closing costs. A couple of the items are pretty straightforward but a couple of others a

Holiday Event Guide Portland, Oregon Area 2022

If you are looking for things to do in the Portland area this last week before Christmas (and the week before the New Year), here are a few ideas... Pittock Mansion 'Music Makes the Season' (through 1/4) - Click image for more info. Oregon Zoo 'Zoo Lights' (through 1/5) - Cli

Molalla Real Estate Update

Here is the Molalla Real Estate update for December 10th:

Why Do People Think the Real Estate Market Will Crash?

The hot topic in real estate right now is a Crash, à la 2008. I am going to discuss the likelihood of a crash… but not here. In cliffhanger fashion, I will put out another article tomorrow in which I’ll discuss the likelihood of a crash. What I’d like to discuss here is why an imminent real estate

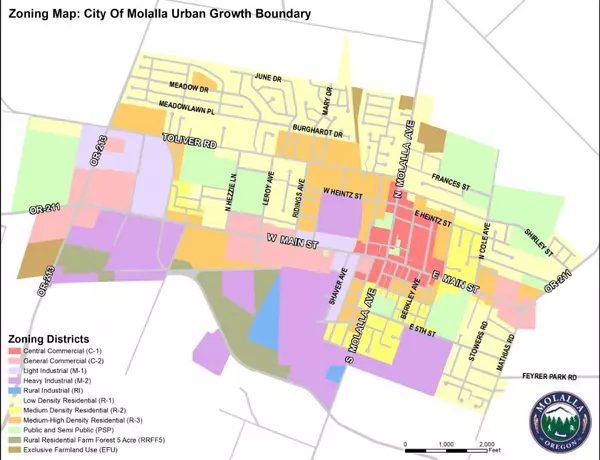

Expanding Urban Growth Boundaries (UGB's)

Though this video is specific to the city of Molalla, it is a good overview of the beginnings of the process of expanding a UGB in Oregon (obviously a good deal less complicated for Molalla than, say, Portland). Representatives from the DLCD (Department of Land Conservation and Development) were a

Discount Points and Origination Points – A Pointed Discussion

In the real estate world, there’s a lot of talk about discount points and origination points. Though both a part of closing a real estate loan, their functions are different. So let’s discuss these pesky customers. Where to start with points? There are two definitions: (1) the underlying mathemat

10 Real Estate Terms You Should Know

10 Real Estate Terms You Should Know Below, find 10 real estate terms that you should know and keep an eye out in the future as I continue to add more and more. My goal is to make these easily understandable to novices to real estate as well as to help clear up and go a little deeper on the definit

What is DTI & Why do I Care?

The first step in buying a house is to get pre-qualified for a mortgage. Without this, the process won't go far - few agents will work with you until you've been pre-qualified and few sellers will accept your offers if you’re not pre-qualified. For your own sake, pre-qualification also lets you kn

Robert's 10 Commandments for Home Buyers

I THOU SHALT NOT CHANGE YOUR JOB, QUIT YOUR JOB, OR BECOME SELF-EMPLOYED. II THOU SHALT NOT BUY A CAR, TRUCK, OR VAN (OR YOU MAY BE LIVING IN IT!). III THOU SHALT NOT USE CREDIT CARDS EXCESSIVELY OR LET CURRENT ACCOUNTS FALL BEHIND. IV THOU SHALT NOT SPEND MONEY THAT YOU HAVE SET ASIDE FOR HOUSE. V

Categories

- All Blogs (15)

- Buyer (7)

- Economics (2)

- Financing (5)

- Holiday (1)

- Investor (3)

- Lake Oswego (1)

- Loan (4)

- Molalla (1)

- Mortgage (4)

- Neighborhoods (1)

- Portland Oregon (2)

- Pre-approval (3)

- Pre-qualify (1)

- Real Estate Knowledge (7)

- Real Estate Market (5)

- Real Estate Terms (1)

- Seller (4)

- Things to do in Portland Oregon (2)

Recent Posts